Strategies for Recovering Failed Payments

Failed payments are one of the most critical issues that negatively impact operational efficiency and long-term customer loyalty. Minimizing errors, increasing successful transaction rates, and strengthening the payment experience are not optional; they are strategic imperatives for every business. What Are Failed Payments and Why Do They Happen? In e-commerce and digital business models, failed […]

Effective Payment Strategies for E-commerce Platforms

In e-commerce, the payment step directly determines whether a customer completes a purchase. Secure, fast, and flexible payment solutions not only increase sales but also enable sustainable business growth. These strategies strengthen customer trust and reinforce brand loyalty. What Are Payment Strategies for E-commerce Sites? Payment strategies for e-commerce sites refer to the set of […]

Ways to Improve Payment Success and Protect Your Revenue

In digital commerce, every payment attempt represents potential revenue. Even minor disruptions in the payment process can lead to direct losses and damage customer trust. The payment success rate should not be viewed as a simple technical metric. It is a strategic indicator that maintains revenue continuity, strengthens customer satisfaction, and enables sustainable growth. What […]

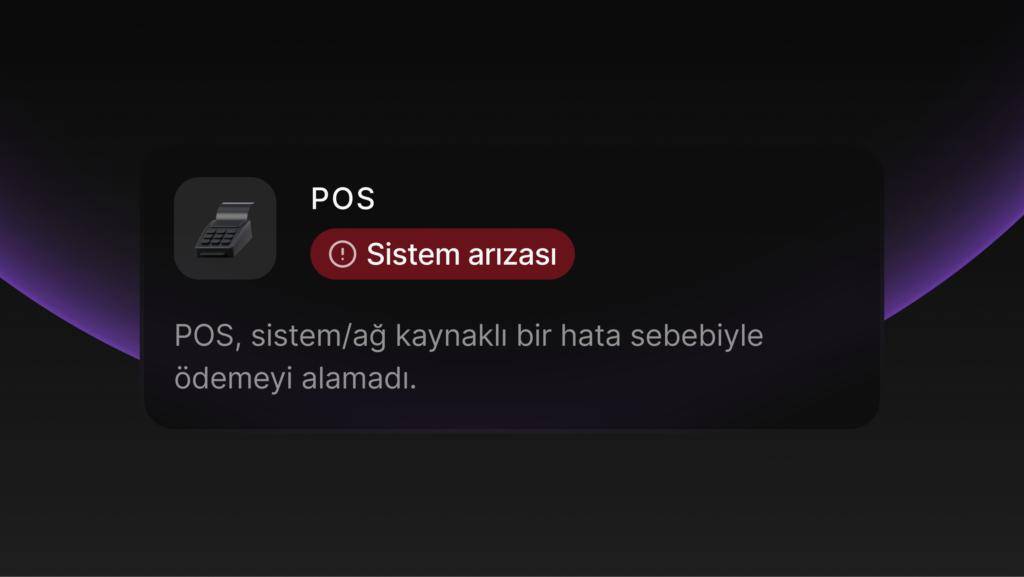

Effective Methods to Reduce Payment Errors

In the e-commerce ecosystem, the payment process is one of the most sensitive points of the customer journey. Even a minor error at this stage can prevent the completion of a sale, interrupt revenue flow, and negatively affect customer perception of the brand. For businesses, minimizing payment errors not only prevents financial loss but also […]

Strategies to Reduce Payment Commissions

In e-commerce, every sale brings revenue, but payment commissions are one of the most significant hidden costs quietly reducing profitability. As sales volume grows, this invisible burden becomes more evident, putting pressure on pricing strategies. High commission rates weaken competitiveness, while a well-managed payment infrastructure provides businesses with significant savings and opportunities for sustainable growth. […]

What Is Payment Orchestration and Its Advantages for Businesses

In the e-commerce ecosystem, the strength of a business’s payment infrastructure is one of the most critical factors defining its potential for sustainable growth and customer loyalty. Offering a seamless experience across various card types, e-wallets, and local payment methods enhances conversion rates and provides a significant competitive edge. At this point, payment orchestration stands […]

Understanding Virtual POS Commission Rates and Calculation Methods

Every payment channel used in online sales directly affects a business’s profitability. Even though Virtual POS commission rates may seem like small percentages, they can create significant cost differences at high transaction volumes. For e-commerce businesses, understanding how commissions are calculated, what factors influence them, and how to optimize them is essential for effective cost […]

How Smart Routing Works Across Virtual POS Systems?

In e-commerce operations, the payment step is the most critical stage, determining whether a sale is completed or abandoned. Smart routing technology reduces transaction failures by directing payments to the most suitable provider, ensuring higher approval rates and a smoother payment process. What Is Smart Routing? Smart routing is a technology that automatically transfers each […]

What is Multi-Virtual POS and How Does It Benefit Your Business?

Multi-virtual POS allows your business to manage multiple payment providers through a single platform. You will find out how this system benefits your business in the rest of the article. Advantages of Using Multi-Virtual POS with Paywall Easy IntegrationPaywall enables businesses to easily integrate with payment providers. Once integrated, you can start using multiple […]

How Can You Avoid Lost Funds And Disruptions İn Payment Processes?

Disruptions in payment processes can be a big problem for businesses. Successful payment process management prevents financial losses while increasing customer satisfaction. This is exactly where PayWatch comes into play, making it easier to track and manage payment transactions. How does PayWatch Work? PayWatch starts working by sending certain parameters during the payment process. These […]