Disruptions in payment processes can be a big problem for businesses. Successful payment process management prevents financial losses while increasing customer satisfaction. This is exactly where PayWatch comes into play, making it easier to track and manage payment transactions.

How does PayWatch Work?

PayWatch starts working by sending certain parameters during the payment process. These parameters enable the transaction process to be monitored and the specified actions to be taken.

PayWatch Parameters

- Watch: Determines whether the payment process will be monitored or not. If this feature is active, PayWatch checks the payment status at specified times.

- Watch Duration (WatchMin): Determines when to check the status of the payment transaction. For example, the check is performed 5 minutes after the transaction has started.

- Action ID (ActionId): Defines the action to be taken after checking the payment status. This can include different scenarios such as reporting, status update or canceling the transaction.

- Payment Statuses (PaymentStatus): Determines which payment statuses will be tracked. For example, statuses such as “initiated”, ‘failed’ or “failed query” can be tracked.

- Webhook Address (WebhookAddress): Defines the web address where feedback will be made according to the transaction result. Thanks to this address, transaction results are transmitted to the relevant systems.

Advantages of PayWatch

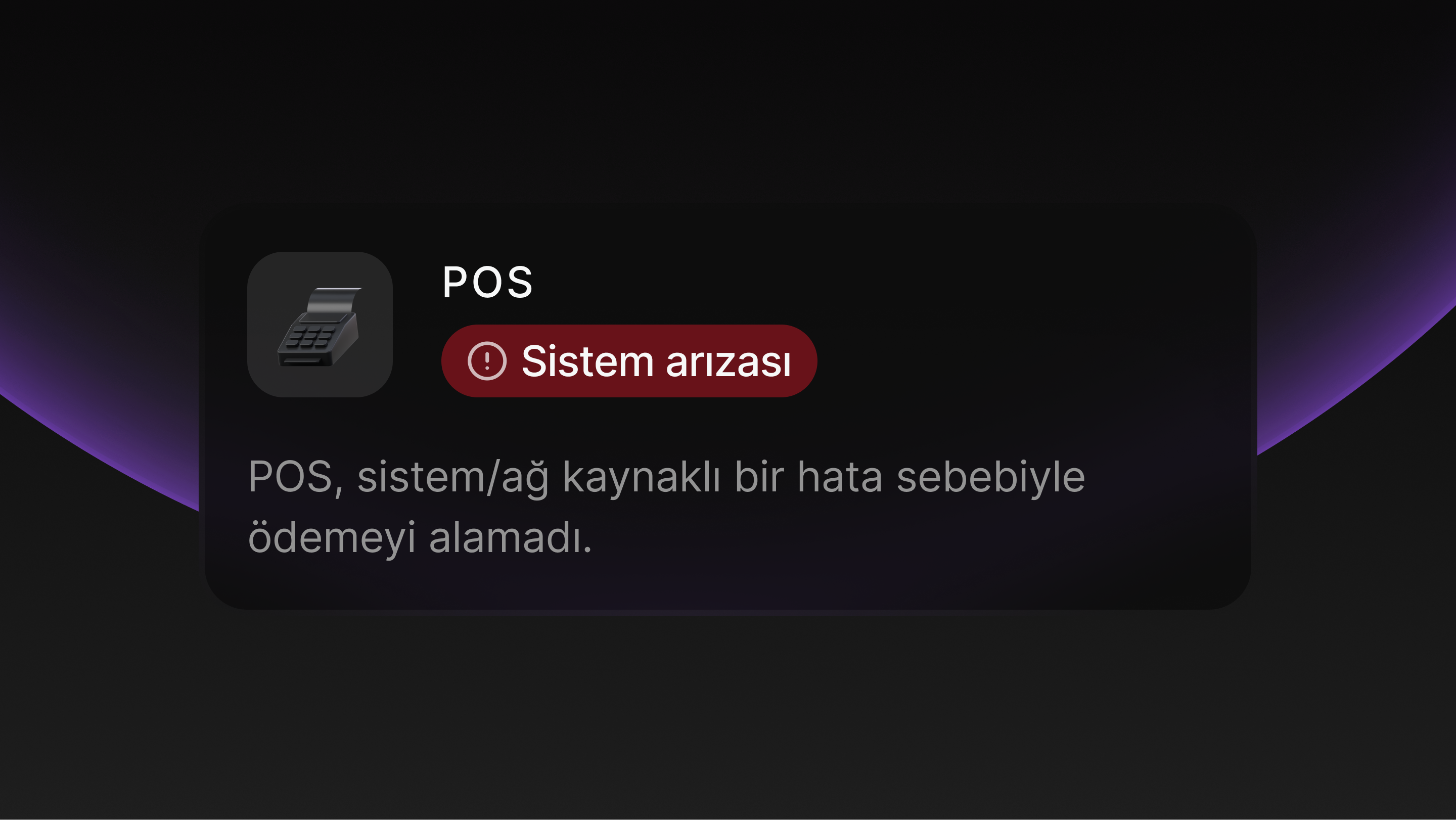

PayWatch is designed to prevent disruptions in payment processes. For example, if a payment transaction continues to appear as “started” due to a technical problem, PayWatch checks the status after a set period of time. If the transaction has been completed successfully, it updates the status and notifies the relevant parties.

Why Use PayWatch?

Provides maximum reliability in payment processes.

Detects and resolves erroneous or stuck transactions.

Improves user experience with real-time monitoring.

Makes the financial processes of businesses more transparent.

PayWatch provides a smooth and reliable payment experience for both businesses using the payment infrastructure and end users.

Translated with DeepL.com (free version)